CUSTOMS DECLARATION MANAGEMENT SOFTWARE (CDMS)

In today's intricate and regulated global trade landscape, customs declarations can become a bottleneck, slowing down trade and increasing costs. we have tackled this challenge head-on with CDMS, a platform tailored to remove these hindrances and make customs clearance more accessible and efficient.

Our cloud-based CDMS eliminates the delays and costs associated with on-premise installations. Experience a smooth registration process and get started without the traditional setup hurdles.

Simple, intuitive, and easy to use cloud-based platform to submit all CDS and UK transit declarations.

Enhanced Speed & Efficiency

With intuitive dashboards and tooltips, CDMS simplifies the creation of customs declarations, ensuring even those new to the system can navigate with ease.

With the reassurance your operations remain fully compliant with HMRC’s CDS, CDMS streamlines and simplifies the customs declaration process, ensuring you spend less time on paperwork and more on what matters.

Our robust APIs ensure seamless data flow, drastically reducing manual inputs and the associated risks of errors. Let our leading edge technology do the heavy lifting, ensuring accuracy at every step.

NEW - CCS-UK Integration

Our latest enhancement is the integration of one of the most sought-after functionalities to our CDMS. We have successfully achieved the CCS-UK Agent Imports Accreditation, a significant milestone that enables both new and existing CNS customers with a comprehensive solution for all their declaration requirements.

Streamlining Processes Across Land, Air and Sea

Our centralised digital platform now consolidates all customer activities in the UK into a single, intuitive interface, streamlining the movement of goods throughout the country’s trade ecosystem.

In an evolving trading environment, CNS's CDMS offers a paradigm shift in customs declarations. It's not just about technology; it's about transforming the way businesses approach customs. Experience simpler, smarter, and more efficient customs declarations today.

The Solution

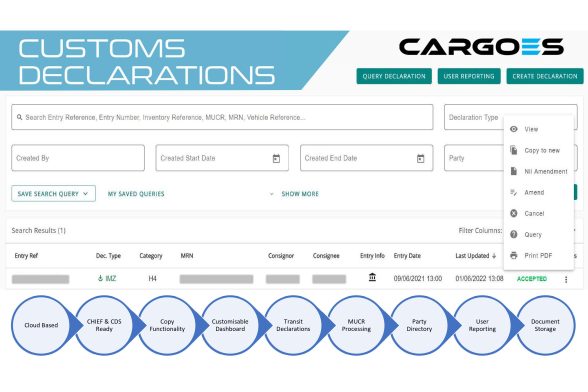

Simple, intuitive, and easy to use cloud-based platform to submit CDS, CHIEF and UK

transit declarations.

Submit declarations for CNS and MCP ports, with CCS-UK integration now live.

Other features include a configurable dashboard, MUCR processing, party

directory and document storage.

The platform has a range of APIs available.

Benefits

- Intuitive dashboards and tool tips will help remove the complexity of creating declarations in CDS.

- Cloud based means no delays and cost for on premise installation with a straightforward registration process.

- The platform can be accessed from multiple locations via multiple users.

- The ability to store all your supporting documents in one location along with the declarations allows greater visibility and a compliant audit trail.

- APIs facilitate the smooth flow of data, removing manual input and reduces the risk of errors.